lending club approval process

When youre ready to make your monthly payment call us at 844-227-5011. The maximum loan amount offered is based.

Case Study Lending Club Ankush Handa

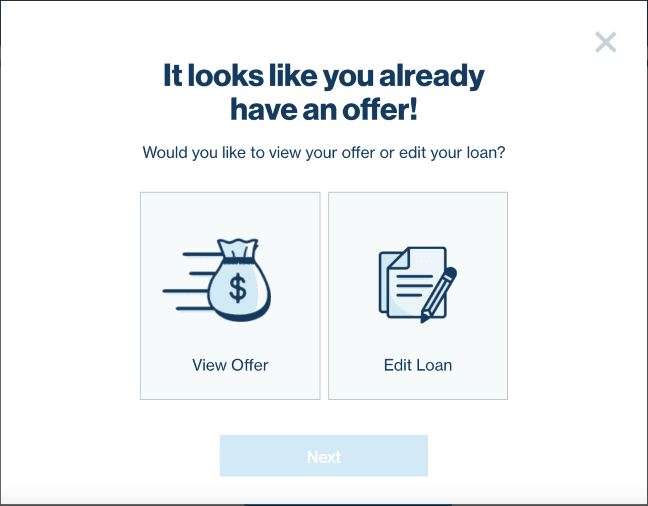

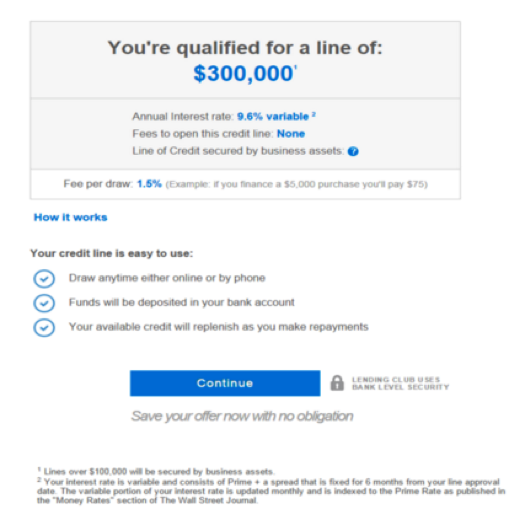

The loan amount you may be approved for depends upon your individual credit profile and the information you provide during the application process.

. Deposit accounts are subject to approval. Revolving lines of credit are issued by Comenity Capital Bank Member FDIC. Installment loans are issued by LendingClub Bank NA Member FDIC Equal Housing Lender LendingClub Bank a wholly-owned subsidiary of LendingClub Corporation NMLS ID 167439.

Their services may help you take care of your immediate financial challenges. Credit Score and History. Our loan officers were simply awesome throughout the whole process.

Unless otherwise specified all loans and deposit products are provided by LendingClub Bank NA Member FDIC Equal Housing Lender LendingClub Bank a wholly-owned subsidiary of LendingClub Corporation NMLS ID 167439. The mutual said that this was. Lending Club Review.

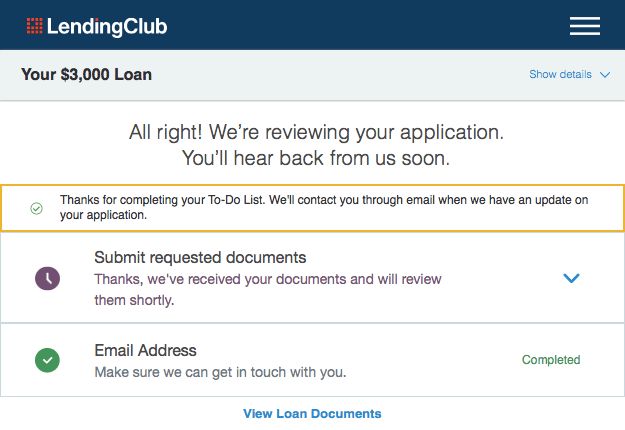

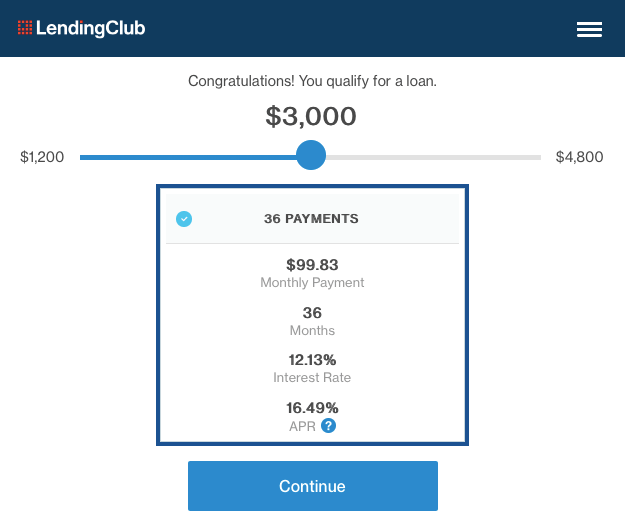

Final loan approval Purchase agreement. Upon approval you can view an online calculator with individual options including the fixed monthly payment for a 36-month loan and a 60. Applications are subject to credit approval.

Call us now and our customer service will take care of you. The Company and its savings bank subsidiary New York Community Bank. LendingClub requirements generally get high marks but they might not be for everyone.

Credit Club Address 15 Gamelin Suite 401 Gatineau Québec Canada. Robert Wann is Senior Executive Vice President and Chief Operating Officer and a member of the Board of Directors of New York Community Bancorp Inc. LendingClub will conduct a soft credit check which wont affect your credit rating.

Small Biz Club is the premier destination. 1 footnote 1 Your initial interest rate is fixed for a short period of time after which it will convert to a variable rate and adjust semi-annually during the life of your loan if the index changes. No unnecessary paperwork Quick application process No faxing required Secure Confidential Need help.

Nationwides gross mortgage lending for 2022 has grown to 365bn up from 265bn in 2021 driven by first-time buyers and buy to let. The report added that it had helped over 87000 first-time buyers which it said was around one in seven novice home owners. Only deposit products are FDIC insured.

Our personal loans range from 2000 to 36500. Payments received before 2 pm Pacific Time will be processed the next business day. Wauconda Community Bank provides Illinois with the resources of a big bank while maintaining the personalized service of a true local community bank.

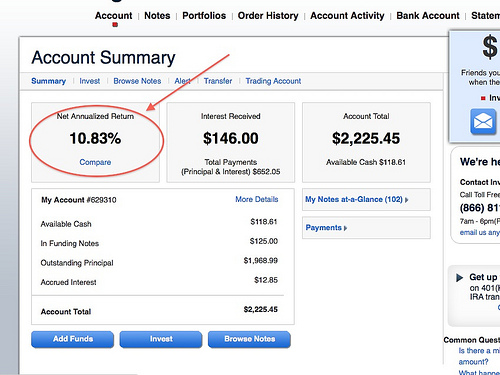

We compared and reviewed the best peer-to-peer lenders based on loan rates fees required credit score and more. Loans are subject to credit approval and sufficient investor commitment. Unless otherwise specified all loans and deposit products are provided by LendingClub Bank NA Member FDIC Equal Housing Lender LendingClub Bank a wholly-owned subsidiary of LendingClub Corporation NMLS ID 167439.

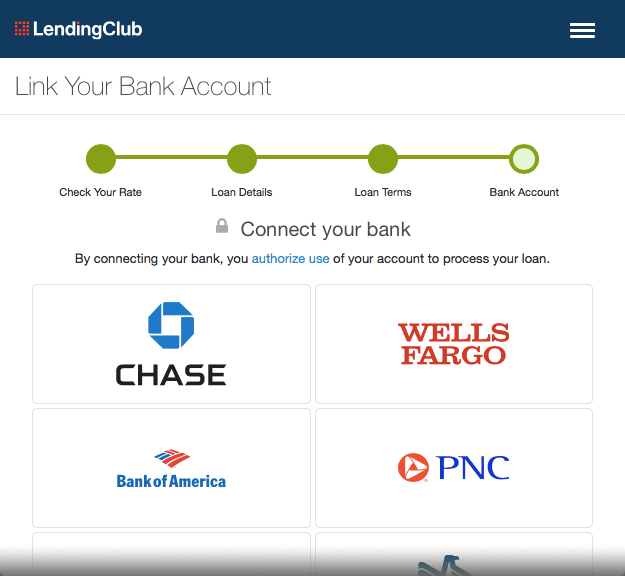

Large banks can be the hardest to get loan approval from with an application process that depends heavily on rigid numerical factors such as your credit score. Be sure to have your bank account information ready every time you call to make a payment. Credit and Lending Real Estate.

Related Mortgage Lending Blog Posts. I could not have asked for better people to work with. Loans are subject to credit approval and sufficient investor commitment.

If youre planning to stay in your home for a relatively short period of time consider an adjustable rate mortgage. Payments received after 2 pm will take another business day to process. Wann has been on the Board of Directors of the Company and the Bank since January 1 2008 and Senior Executive Vice President and Chief.

According to Biz2Credits Small Business Lending Index recent credit union approval rates for small business loans are around 45. Credit Club does not offer automatic renewals on its payday loans. Lenders help you get out of a fix by providing short-term bad Credit Loan with 100 approval.

An applicants credit score is one of the most important factors a lender considers when evaluating a loan application. Peer-to-peer loans are funded by individual and institutional investors. Renewal of your Payday Loan.

Theres no cause for alarm as youre in the right place and will receive significant financial assistance.

Lendingclub Com My Peer To Peer Loan Review Financial Sumo

How To Apply For A Loan On Lending Club Youtube

Home Improvement Loans Lendingclub

Lending Club Review For Borrowers 2019 Is This Company Legit

What To Expect When Borrowing From Lending Club Part Time Money

Lendingclub Review My Experience Using It Moneyunder30

Lending Club Review For Borrowers 2019 Is This Company Legit

Lendingclub Personal Loans Review 2022 Nextadvisor With Time

P2p Lending Archives Page 2 Of 7 Finovate

Lending Club Review For Borrowers 2019 Is This Company Legit

Lending Club Review For Borrowers 2019 Is This Company Legit

Lending Club Review How It Works Requirements And Alternatives

How Long Does It Take To Get Approved For A Loan Lendingclub

Lending Club Reviews For Investors And Borrowers Is It Right For You

Lendingclub Com My Peer To Peer Loan Review Financial Sumo

How To Apply For A Personal Loan 6 Steps Lendingclub

Step By Step Lending Club Business Loan Application In Real Time

Lending Club Usa 2022 Reports Reviews Scampulse Com

Lending Club Offers New Lenders 50 To Get Started On Its Peer To Peer Platform Finovate